Brief History of Coins and Currency

India is one of the few claimant nations for earliest introduction and usage of coins, made from stone and metals as store and media for exchange of values. These most probably had ringed bells for stoppage of barter system. Researchers have observed that use of coins in India dates to period from the first millennium before the common era (BCE) to the 6th century BCE. Before such metal coins ‘Cowrie Shells’ and beads used to be exchanged as money for buying of goods and services.

Historians could trace coin minting activities in India during the period of several ancient rulers of kingdoms, viz., Magadha, Ghandhara, Shakya, Surasena, Panchala, etc. They launched such coins for use as legal tenders by their subjects. Those coins were known as Pana or Karshapanas. Historians could also find that Chinese and Lydian rulers of middle east region were two of the earliest introducers of coins. Mughal emperor Sher Shah Suri minted the first gold coin, called Mohur in India, during his rule between 1540 to 1545. Storylines indicate that the modern version of the name of Indian currency ‘Rupee’ owes its historical lineage from the silver coin called ‘Rupiya minted by Sher Shah Suri. It is pertinent to note that Indian word for silver is ‘Rupa’

Fiat Currency and Bank Money

This tradition of metallic coins continued till the advent of British era in India around which time paper currency notes started replacing metal coins with high intrinsic values. However, centuries old tradition of using metal coins continues even today albeit on a reducing trend. The colonial rulers of India started blocking village level Indigenous bankers, who used to operate with metal coins, at the onset of their rule. Organised banks, sponsored by both private owners and government, started operating on a regional basis.

The General Bank of Bengal and Bihar, a state sponsored bank, was one of the first few issuers of paper currencies during 1773 to 1775. Since then both private and government sponsored banks used to issue paper currencies which were used by people in regional markets. According to a publication of Reserve Bank of India1, “The paper currency Act of 1861 divested these banks of the right to note issue; the Presidency Banks were, however, given the free use of Government balances and were initially given the right to manage the note issues of Government of India.” This Act heralded the control of the Indian central bank on fiat currency and money circulation in India.

Presently there are three types of money in the financial ecosystem of any sovereign country, viz.,

- Fiat Cash or Currency: It is issued and controlled by its central bank and not backed by any commodity like gold. Fiat currency provides greater control to the central bank on the country’s economy.

- Central Bank Money: This money is created out of reserves of a country’s central bank and is used by commercial banks for settlement of transactions by and between themselves. Total magnitude of this form of money is not considered as a part of money supply to the economy as it is not meant for any purpose beyond the close circuit of country’s banking ecosystem.

- Central Bank Money: This money is created by government and private commercial banks by lending to retail, and corporate customers from out of various short-term and long-term deposits received from retail and institutional customers. This huge bulk of money is stored in the computerised accounting systems of banks and circulates through innumerable day-to-day transactions conducted by banks’ customers.

It is, therefore, evident that all the above three forms of money are, for all practical purposes, under direct monitoring and control of the central bank of any country, because the commercial banks are also under regulatory control and close supervisions of the central bank.

Birth of the Cryptographed Digital Currency

Digital currency originated from the disgruntled mindset and anguish of common people that banks have failed to provide security and safety of their deposits, not to speak of reasonable return in real terms net of inflationary effect. A section of people wanted to become the controller of their own destiny due to heightened anguish caused by global financial crisis post subprime loan meltdown in September 2008. In India, the matter has assumed critical dimensions due to recent failures of a couple of banks to meet commitments to retail customers primarily caused by persistent huge quantum of non-performing assets, i. e., long overdue loans and interests thereon.

Readers may be aware that the first idea of digital currency can be traced in 1998 when an IT engineer called Wei Dai2 published a paper on digital currency called ’B-Money’. His idea was to enable a group of unnoticeable ‘Digital Pseudonyms’ to transfer values within a network. In the same year Nick Szabo2, ideated another decentralised digital currency called Bit Gold. This lawyer turned professional cryptographer was one of the pioneers of blockchain technology. Szabo claimed that his idea was provoked by inadequacies in the traditional banking systems. However, both these were never launched in public domain.

The world witnessed birth of the first cryptocurrency ‘Bitcoin’ in 2009 through the widely read article “Bitcoin: A Peer-to-Peer Electronic Cash System”, published by Satoshi Nakamoto3. Predominant objectives of Bitcoin were to liberate liquid assets of common people from the clutch of central bank of a country, so that people can control their own destiny. World debated whether Wei Dai, Nick Szabo and Satoshi Naka are one and the same person with three different names. The most debated issue that remains to be concluded is, whether privately issued cryptocurrencies have really so far served the originally ideated objectives.

The author is not aware whether the mystery around the name Satoshi Nakamoto has yet been demystified, and whether the person has physically been traced anywhere under the sun. However, one school of thought is that the name represents a group of IT professionals who ideated virtual currency. The quoted article of Satoshi Nakamoto claimed the following:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work…..”

Satoshi Nakamoto created a digital platform for steering transactions by participants in a peer-to-peer network for Bitcoin using Blockchain Technology which is synonymously known as ‘Distributed Ledger Technology’ (DLT).’ The underlying basis and controlling tool is an embedded smart contract entered by and between transacting parties, as opposed to any central bank’s regulations. The author in some of his previous articles in this series on ‘Digital Transformation’ has explained Blockchain technology in detail, and hence are not being repeated here. Those articles are available at his personal

website: http://www.innoventionians.com/category/knowledge-inputs/

Cryptocurrency Transactions without Intermediation

The decentralised and distributed authority structure between participants of a Blockchain platform enabled a digital currency to remain beyond the realms of regulations and control of any central authority. The peer-to-peer network facilitates direct online remittance payments by and between participants without the intermediation of any common agency like a bank.

The word crypto draws allegiance from the fact that every transaction in a blockchain platform is cryptographed on an end-to-end basis with complex algorithms. Such applications of cryptography are also for ensuring controlled addition of new digital currency units; authenticate, monitor, and record transactions; and to create a risk-enabled safety net to prevent frauds and infringement by cyber criminals. Applications of algorithms for encryption render such a digital currency near impossible to be counterfeit or double-spend. That is why any digital currency transacted through a blockchain platform is also called ‘Cryptocurrency’.

A cryptocurrency is synonymously known, and also being used in this article, as Digital Cash, Digital Asset, Digital Currency, Digital Token, Virtual Currency, etc. It is touted to function as an alternate medium of exchange to secure financial transactions and verify transfers through a secured and integrated DLT platform. Investopedia4 summarises that “Cryptocurrencies face criticism for a number of reasons, including their use for illegal activities, exchange rate volatility, and vulnerabilities of the infrastructure underlying them. However, they also have been praised for their portability, divisibility, inflation resistance, and transparency.” Since 2009 the world has seen launch of many cryptocurrencies. The following is a pictorial illustration of some of those:

Source: https://www.rarealtcoin.com/worlds-top-3-scrypt-algorithm-altcoins-long-term/

Despite all hypes around bitcoin and its price breaking through the summit of USD 20,000, cryptocurrency is yet to be a familiar word to a common man and meant for her / his daily use like internet or a application like WhatsApp. Most of high-net-worth individuals around world have yet not accepted cryptocurrencies, including Bitcoin a safe haven to invest.

Albeit all these, threat to fiat currencies and bank money under any central bank’s control is continuing. Readers are aware that mighty facebook is expected to launch a cryptocurrency called Libra. Many resistances forced it to initially launch Libra at a lower scale around April 2021. Because of gargantuan mass appeal of facebook even to the lowest strata of society across all countries and its worldwide network, Libra is expected to be popular within no time. It is likely to pose tangible threats to fiat currencies and commercial banks’ money regulated by any country’s central bank.

Industry 4.0 and Fintech for Digital Payment

Digital transformation of industrial operations and service deliveries by entities in banking, insurance, and other financial services (BFSI) started from around the later part of 1990s. But even before that came physical media for cashless payments through Debit Cards and Credit Cards issued by commercial banks. According to a report in Marketplace5 Kansas City Federal Reserve, a bank in the USA, started the first Debit Card in 1966. It reported that “Robert Manning, the author of Credit Card Nation, said debit card usage picked up in the ’80s and ’90s as more and more ATMs started cropping up across the country. In 1990, debit cards were used in about 300 million transactions. In 2009, prepaid and debit cards were used in 37.6 billion transactions.”

With further advancement of technologies digitally enabled cash-less payment started gaining momentum and reached today’s version of digital wallets and payment interfaces. Specific computing applications enabled individuals to make payments without use of Debit and Credit Cards, or any other form of intermediation by banking system. Usage of such debit and credit cards also came up with advanced applications like PIN less / touch less payment confirmations. Even before onset of Covid-19 Pandemic many startups developed digital solutions for contactless payment systems with applications of technologies like radio frequency identification (RFID) and near field communication (NFC). World witnessed emergence of eWallets and digital payment platforms of PayPal, paytm, ApplePay GooglePay, SamsungPay and so on. The case in point for an eWallet is the one used by car hailing service providers like Ola.

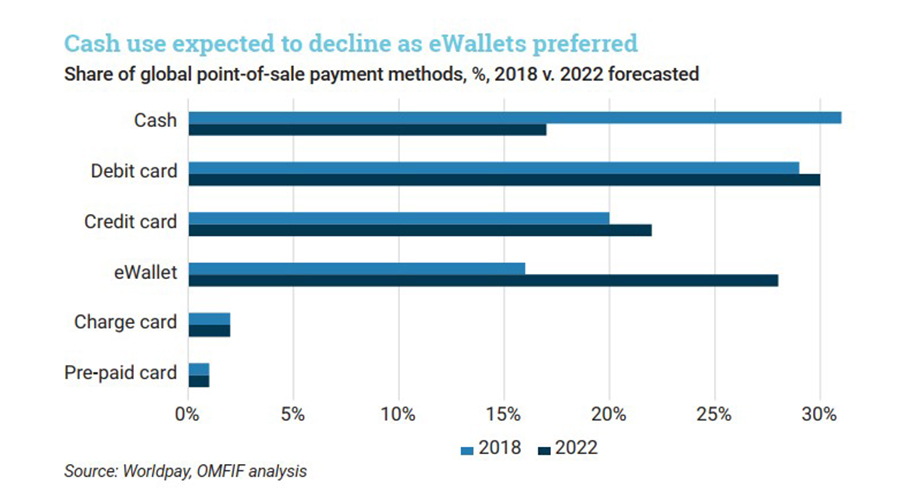

The following chart of a research-based report by Worldpay, published in a report of IBM6 use of hard physical feat currency will decline from about 32% in 2018 to about 17% in 2022. Use of eWallets will increase from around 16% in 2018 to about 29% by 2022.

Source: https://www.mfif.org/wp-content/uploads/2019/11/Retail-CBDCs-The-next-payments-frontier.pdf

Multiple Opinions on Cryptocurrencies

Readers should not be surprised to note that regulators around the world are divided in their opinions about the exact nature of a cryptocurrency as an asset and store of value. Many have even regarded it as a commodity and advised their respective sovereign government to impose value-added tax on related transactions.

Four major regulators of the world’s largest economy had initially expressed three different views on digital currency, Bitcoin to be precise. The author through his research observed that in a panel discussion session of a Blockchain Summit at the New York City Bar Association in June 2018 those four Regulators deliberated on various related issues. They represented the Securities Exchange Commission (SEC), the Commodities Future Trading Commission (CFTC), the Financial Crime and Enforcement Centre and the Internal Revenue Services (IRS). The Moderator of the session pointed out how different regulators do not even use the same language to define digital tokens or cryptocurrency: Those regulators considered digital tokens as:

- SEC – Securities

- CFTC – Properties

- FinCen – Currency

- IRS – Properties

The said Moderator was not sure whether concerns about regulations are likely to dissipate anytime soon. His question was if the layers of regulation could lead to new financial technology being developed in other countries instead of the USA. However, clarity of thought amongst regulators and multilateral agencies is an essential necessity for the fourth type of asset to come up in this era of Industry 4.0 for successful and all-pervasive digital transformation.

The author would prefer to add the following to clear misgivings in minds of common people, who are of the view that failure of Blockchain technology is responsible for several reported frauds related to crypto currency transactions. Many have concluded that Blockchain, like any other technology, cannot prevent frauds. Let this be clearly understood that the meteoric rise and volatilities in prices of Bitcoin and other cryptocurrencies are not due to the fault of Blockchain as a technology. Instead, those are mainly due to interplay of factors, viz., demand, supply, dogma of a new capital asset, human gluttony and other common factors influencing business and financial ecosystem of any country. The author is of the view that:

- Those are not the frauds committed by infiltrating into the concerned Blockchain platform. Human gluttony and ulterior motives have played forceful roles like in any other case of economic offenses.

- The reported frauds had occurred in course of cryptocurrencies being traded in exchanges operated by separate entities. Most of the buyers and sellers do not directly access the Blockchain platform from their respective Nodes. Their brokers in those exchanges do, unscrupulous activities by whom can never be ruled out and ignored.

Having observed differences in opinions of the US Regulators, research scholars Stephen J. et al, in their article7 published by Harvard Business Review in July 2018, had suggested the following in the context of the USA for resolving issues surrounding cryptocurrencies:

- Encourage formation of a self-regulatory body to promote and enforce standards among the crypto community.

- Convene an inter-agency working group, including representatives from the crypto community, to harmonize existing regulatory practices and develop a formal policy on cryptocurrencies.

- Provide public notice of a proposed rule governing cryptocurrencies and gather comments.

- Officially recognize that the extent of decentralization is an important factor in determining whether a cryptocurrency is a security.

- Go beyond the appointment of a crypto czar. Let SEC follow the lead of the Commodities Future Trading Commission, USA which created LabCFTC, an initiative for promoting innovation in fintech. Cues from that would give SEC opportunities to directly engage with industry to address questions about enforcemen of securities related laws to blockchain technologies before launch.

They were of the view that these steps will help to promote order, consistency, and accountability within the cryptocurrency market without imposing undue burdens. Such steps would help the United States emerge as a wise leader for regulating introduction and use of cryptocurrency. This will in turn spur entrepreneurship and innovation in this country. According to them “Wisdom – more than ignorance – is a truer form of bliss”.

Readers might have by now guessed that importance of bank as an intermediator, particularly for country’s payment and financial settlement ecosystem, is reducing day by day. Besides payments, applications of blockchain platforms have started being used for end-to-end handling of both domestic and cross border trade finance transactions, management of bonds, peer to peer lending loan management by microfinance organisations and many more. However, digital transformation involving interoperability of Blockchain platforms for transactional applications are being impeded due to non-availability of a commonly accepted digital currency. Industry sectors like financial services, healthcare, eCommerce, supply chain management, aggrotech, etc., and even governmental services too are the most affected segments.

Emergence of CBDC

IBM in its publication titled ‘Retail ÇBDCs – The next payment frontier’6 of 2019 has aptly reflected the concerns of both common people and central banks. It stated that, “Advances in financial technology are impelling central banks to react to emergent challenges from the private sector and address weaknesses in payments systems. Policy makers are concerned about the potential loss of monetary control, and there is momentum in their institutions to examine the potential effects of introducing retail CBDCs”. Since the global financial crisis of 2008 all stakeholders of monetary and banking systems around the world have squarely been influenced by the following three major developments:

- A dramatic multiplication of a sense of trust deficiency in behaviour and functioning of regulators, banks, and financial institutions.

- Efficacies of policies and systems of central banks related to oversight of banks and financial institutions befitting the fast-changing and country / region specific dynamic environment of industry trade and commerce.

- Continuous fall in usage of cash due to innovative digital solutions offered by startups for payments and remittance management with improved speed, quality, reliability, and cost effectiveness.

In such a given dynamic financial environment and crisis of trust cryptocurrencies are slowly and steadily becoming global. Such an escalated trend of cryptocurrencies is leading to more and more acceptance and use cases. Major corporate houses around the world are showing higher degree of interest in blockchain and cryptocurrencies by investing more for those. All these will speed up the process of expanding markets for digital currencies. Time is here and now for central banks of sovereign nations to also roll out their respective cryptocurrencies called Central Bank Digital Currency (CBDC).

It would be worthwhile to understand now the definition of CBDC. The Committee on Payments and Market Infrastructure (CPMI)8, appointed by the Bank of International Settlement (BIS), explained nuances of CBDC in the following lines.

“CBDC is potentially a new form of digital central bank money that can be distinguished from reserves or settlement balances held by commercial banks at central banks. There are various design choices for a CBDC, including: access (widely vs restricted); degree of anonymity (ranging from complete to none); operational availability (ranging from current opening hours to 24 hours a day and seven days a week); and interest-bearing characteristics (yes or no). … Many forms of CBDC are possible, with different implications for payment systems, monetary policy transmission as well as the structure and stability of the financial system. Two main CBDC variants are ……. a wholesale and a general purpose one. The wholesale variant would limit access to a predefined group of users, while the general purpose one would be widely accessible”

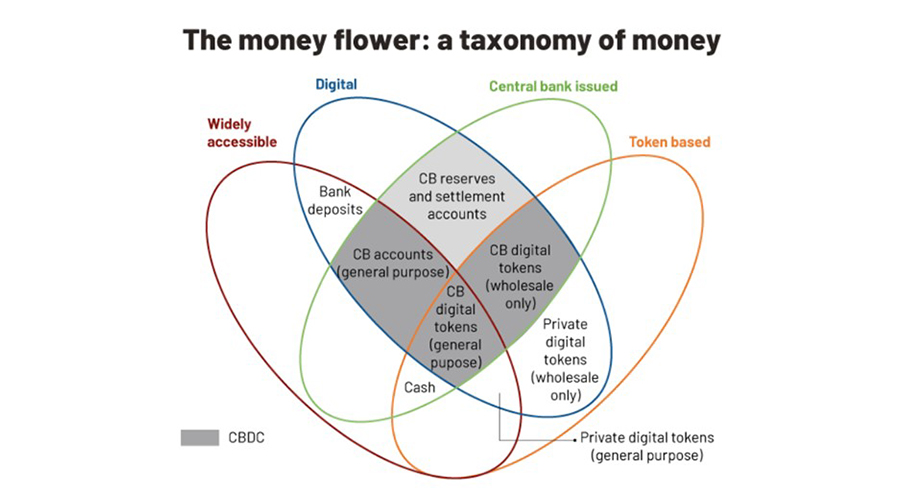

The following graphics aptly summarises the features of CBDC by combining more than one Venn Diagrams and naming their cross sections. This combined iconic expression is called ‘The Money Flower’ developed by way of Taxonomy for CBDC in 2017 by Morten Bech and Rodney Garratt for BIS.

Not much of narratives are required to explain the above diagram as most of the features of a digital currency and CBDC have been explained in the aforesaid discourse. Attention of readers is drawn to the shaded portions which depicts the distinguishing features of four possible types of Customers’ Accounts for usage of CBDC, viz., Reserves and Settlement, General Purpose usage of CBDC by Retail Customers, Digital Tokens for General Retail Customers and Digital Tokens for Wholesale Customers. This diagram has also featured Cash (fiat currency notes / bills) and General Purpose Digital Tokens issued by private entities.

Initiatives of Major Central Banks for CBDC

A report9 published in 2020 by seven of the world’s largest central banks jointly with the Bank of International Settlement defined CBDC as “…. a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank.” The report highlighted the following:

- Coexistence with cash and other types of money in a flexible and innovative payment system.

- Any introduction should support wider policy objectives and do no harm to monetary and financial stability.

- Features of a CBDC should promote innovation and efficiency.

The group had promised to continue to work together on CBDCs, “without prejudging any decision on whether or not to introduce CBDCs in their jurisdictions.” More reading of the above report reveals the following features of a CBDC:

- A digital asset issued by a central bank.

- Objective is to facilitate payment and settlement.

- Usable for retail transactions by all common man as a digital extension of cash at no additional cost

- Usable for settlement of wholesale transactions to be conducted and settled by permissioned corporate entities in an interbank market.

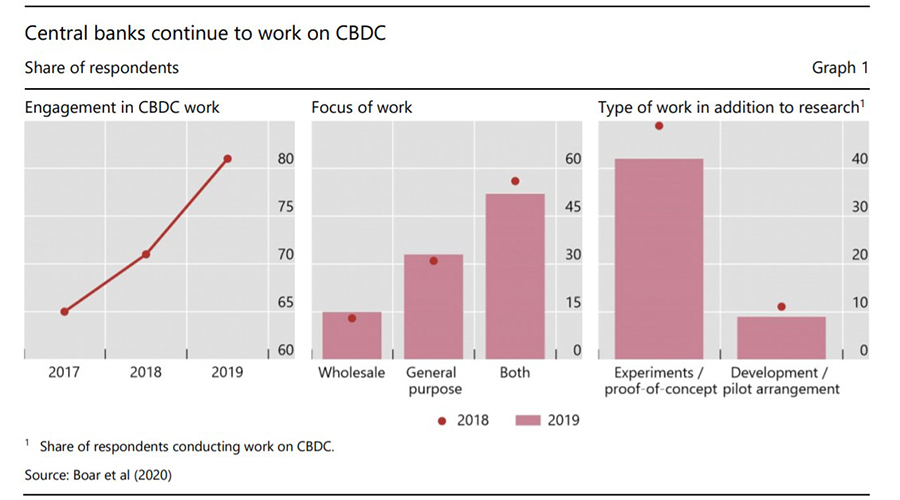

The report assured people in general by stating that “Arguments for and against issuing a CBDC and the design choices being considered are driven by domestic circumstances. There will be no “one size fits all” CBDC. Yet domestic CBDCs would still have international implications. Cooperation and coordination are essential to prevent negative international spill overs and simultaneously ensure that much needed improvements to cross-border payments are not overlooked.”. The following chart, included in the said joint report, brings out the present state of affairs in matters of initiatives by central banks of various countries for introducing CBDC.

Source: https://www.bis.org/publ/othp33.pdf

One can make out that more than eighty central banks of different countries have engaged themselves in preparatory work for introducing CBDC. About fifty of them have focussed on both Wholesale and General Purpose CBDC. And about fifty of those central banks are in varying stages of experimentation with proof of concept and pilot arrangements. Wim Boonstra. Senior Vice President, Special Economic Advisor and Economist at RaboResearch Global Economics & Markets, in his article of December 202010 has indicated that, “People’s Bank of China (PBoC) has developed the Digital Currency for Electronic Payment (DCEP)”. The summary of his report runs as under. All these have, however, not further been researched and confirmed by the author of the present article:

- China may be the first major country to launch a central bank digital currency or CBDC

- The Chinese CBDC, named DCEP, will strengthen the position of the central bank and help to further modernize the Chinese economy

- The DCEP will probably also be available for China’s trade partners, to begin with Africa

- The DCEP may strengthen the international position of the renminbi to the detriment of the euro

- The arrival of the DCEP should be a strong wake-up call for Western, especially European, policymakers.

The important point to be noted here is that DCEP, the CBDC of China may be a digital currency that will be accepted as a medium of financial transactions in certain African countries who are China’s trade Partners.

Tanjeel Akhtar in her article11 of December 2020 wrote about a digital currency which has been issued on a limited scale within a city area. The Spanish City Council of Lebrija has created the virtual currency Elio to support economic activity during the COVID-19 pandemic. One Elio is equivalent to one euro and almost 600 families will receive between €20 (US$24.50) and €200 ($244.96), which can only be spent in local businesses using an app. The deadline to use the Elio was Dec. 31, 2020, but has been extended till March 31, 2021.

IMF’s Working Paper and Anxieties on CBDC

IMF published its Working Paper12 titled, ‘Legal Aspects of Central Bank Digital Currency: Central Bank and Monetary Law Considerations’ as late as on November 20, 2020. It would be useful to quote verbatim the summary for better understanding of readers:

“This paper analyzes the legal foundations of central bank digital currency (CBDC) under central bank and monetary law. Absent strong legal foundations, the issuance of CBDC poses legal, financial, and reputational risks for central banks. While the appropriate design of the legal framework will up to a degree depend on the design features of the CBDC, some general conclusions can be made. First, most central bank laws do not currently authorize the issuance of CBDC to the general public. Second, from a monetary law perspective, it is not evident that “currency” status can be attributed to CBDC. While the central bank law issue can be solved through rather straight forward law reform, the monetary law issue poses fundamental legal policy challenges.” Readers will get a feeling that the Authors of the Working paper are admittedly:

- Not clear about certain legal aspects and implications of CBDC on the functioning of commercial banks and central bank of respective countries.

- Not sure whether central banks of a country need to be legally authorised for issuing CBDC to public in general.

- Apprehensive about the fact that absence of legal foundations CBDC may cause legal, financial, and reputational risks for central banks.

In addition to the above concerns of IMF the author’s more research work reveals that economists and finance professionals have expressed anxieties on the following issues which extend far beyond the issues related to payment systems, legislative amendments, and collaboration with private technology providers for running the blockchain based platforms:

- CBDC permitted by a Central Bank for issuing to common people may result in higher volatility and insecurity in deposit funding of commercial banks.

- A general purpose CBDC can be a self-competitive item vis-à-vis the existing term of deposits related services provided by commercial banks with pre-declared assured rates of interests. This may also pose challenges for funding and financing structure of banks.

- In an assumed condition that CBDC is only legalised for payment and settlement purposes, commercial banks and central banks of a country may have to encounter grievous challenges, and then successfully handle the same in periods of stress when a flight towards the central bank may occur on a fast and large scale.

- Institutionalisation of CBDC with legislative permission will result in wide-spread and more than existing presence of central banks in a financial ecosystem of a country, which may not be desirable.

- Introduction of CBDC would bring in its wake a much wider role for central banks in distributing financial resources. It may cause directional changes in roles and responsibilities of central banks into uncharted territories which may result in high degree of political interferences and eventual financial losses for central banks.

- Setting principles, policies, and standards to be complied with for the technology to be applied and digital platform to be maintained for operations with CBDC would be a challenging additional burden for central banks besides ensuring privacy, safety, and security of information.

Carlos et al in their seminal work13 titled ‘The Future of Money and the Central Bank Digital Currency Dilemma’ identified the following risks in the context of cryptocurrency and CBDC:

- Risks of a cashless society,

- Risks of structural bank disintermediation,

- Risks of systemic bank runs,

- Risks of currency substitution, and

- Risks of economic and financial bubbles.

Readers may refer their paper describing ‘Three-Pillar Monetary-Financial Framework’. They have claimed that their proposed framework will guide the assessment of CBDCs which are considered as the next step in monetary evolution.

Global Status of CBDC

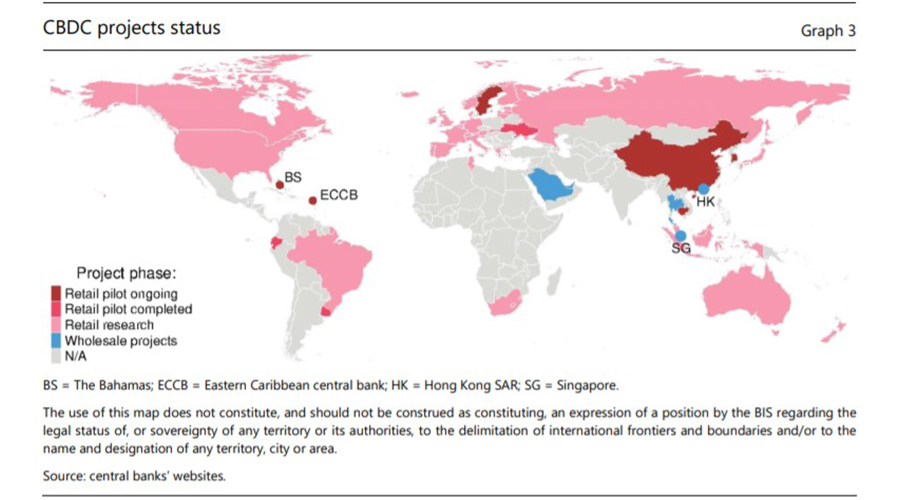

Working Paper No. 88014 of Bank of International Settlement, published in August 2020 has presented the status of implementation of CBDC around world till July 2020 through the following graphical expression of world map:

Source: https://www.bis.org/publ/work880.pdf

It is evident that most of the developed countries of North America and Europe, Australia, New Zealand, South Africa, north-eastern countries of South America have completed pilot study for Retail CBDC. In China the same is under progress. Projects for Wholesale CBDC is under progress in Gulf countries, Hong Kong and a few countries of East Asia.

BIS has further explained in the said report that, “As of mid-July 2020, at least 36 central banks have published retail or wholesale CBDC work (Graph 3). At least three countries (Ecuador, Ukraine and Uruguay) have completed a retail CBDC pilot. Six retail CBDC pilots are ongoing: in the Bahamas, Cambodia (Bomakara (2019)), China, the Eastern Caribbean Currency Union.”

Readers may be amazed to note the progress in countries which are smaller than India. With this pace of progress, it may not be wrong to visualise that by around 2025-27 the world will see worldwide initiation of CBDC even for settlement of cross border transactions, which will eventually render decades old usage of SWIFT redundant.

Present Status of CBDC in India

The National Institute of Smart Governance of India published the ‘National Strategy for Blockchain’15 in December 2019. In this document the concept of ‘Central Bank Digital INR’ (CBDR) was mentioned. The stated objective is to facilitate the process of innovation in areas of digital transformation. It suggested that CBDR can be operated through a ‘National Permissioned Blockchain’ platform that can run decentralised operations. The document suggested that, “Permissioned blockchain applications can also account for regulatory oversight through participatory nodes by corresponding regulators and leverage the National Public Blockchain platform as a trust anchor.”

The Indian newspaper Mint16 reported on December 5, 2019 that RBI Governor Saktikanta Das has ruled out the possibility of granting permissions for privately-issued digital currency. He has been quoted to have said that it was a little early to talk of Indian Central Bank issuing CBDC, albeit RBI had internally examined it and discussions being on. According to the Governor the related technology has not fully evolved.

Big Questions for Deliberations

A situation of chaos may arise if individual nations frame their own rules and regulations for introduction and management of CBDC from the narrow perspectives of meeting their respective country’s dynamics and serving their own interest only. This may hinder progress of cross border trading and settlement of transactional dues. The process involving 4Cs, viz., consultation, consensus, cooperation, and collaboration should be followed. Multilateral agencies like IMF, World Bank, OECD, etc should propagate directional guidelines, policies and procedures for digital solution designing, introduction, management, and monitoring of CBDC at individual national levels.

This should be done after consensus is reached based on views obtained on a working paper. Objective should be to derive maximum benefits out of innovative solutions being provided by digital scientists for safe, cost effective and speedier management of transactions for financing, trading, settlement of liabilities, remittances, etc, both at domestic and multinational levels. The ultimate goal should be to reach benefits to all human beings across all societal hierarchies of all nations.

One of the intrigued questions to be examined, and addressed by such multilateral agencies is, whether the central bank of any country should allow one or more cryptocurrencies issued by private entities like Bitcoin, Ethereum, Ripple, Libra, etc, to parallelly operate with CBDC. The issues that should also come for intense debate are the complexities and clash of interests which would arise due to such privately issued cryptocurrencies participating in transactions with decentralised authorities transcending sovereign boundaries. Some more complex issues to be resolved are:

- Whether the underlying economic foundation and the superstructure of financial ecosystem of a country will be shattered by such parallel applications of CBDC and privately issued cryptocurrencies?

- Whether at all there can there be peaceful co-existence of CBDC of individual nations and cryptocurrencies of private organisations?

- Whether any nation should allow their own CBDC to be used by another or more other nations which are financially helped and supported by them, as opposed to the present convention of every nation having their own currencies, and exchange rates being determined by market forces.

Conclusion

The author is of the view that CBDC is no longer a matter of option and choice for the government and central bank of any sovereign nation. It is an imperative and has become an essential necessity, CBDC with all its variants will soon emerge as the only option for keeping pace with digital transformation of industry, trade, and commerce, and particularly FinTech segment of BFSI sector.

Government of India and RBI should not and cannot opt to remain a quiescent spectator while common people increasingly embrace smart technologies for cashless / touchless payments, digital wallets and Banks in India face fierce competition from time efficient and cost effectively FinTech players. Discourse in this article has indicated the speed at which most of the developed countries are progressing with pilot runs of CBDC. It will prove to be expensive with retarding effects if actions are not initiated without any further delay. One should not continue to be under the impression that technology is still evolving. If need be technology has to be ‘innovented’. The author is aggressively optimistic about pervasive success of CBDC all around the world much before the end of the ensuing decade.

Webliography

- https://www.rbi.org.in/commonman/English/Currency/Scripts/EarlyIssues.aspx#:~:text=The%20paper%20currency%20Act%20of,issues%20of%20Government%20of%20India

- https://www.ledger.com/academy/crypto/a-brief-history-on-bitcoin-cryptocurrencies

- https://bitcoin.org/bitcoin.pdf

- https://www.investopedia.com/terms/c/cryptocurrency.asp

- https://www.marketplace.org/2011/08/18/short-history-debit-card/

- https://www.omfif.org/wp-content/uploads/2019/11/Retail-CBDCs-The-next-payments-frontier.p

- https://hbsp.harvard.edu/download?url=%2Fcatalog%2Fsample%2F10282-PDF-ENG%2Fcontent&metadata=eyJlcnJvck1lc3NhZ2UiOiJZb3UgbXVzdCBiZSByZWdpc3RlcmVkIGFzIGEgUHJlbWl1bSBFZHVjYXRvciBvbiB0aGlzIHdlYiBzaXRlIHRvIHNlZSBFZHVjYXRvciBDb3BpZXMgYW5kIEZyZWUgVHJpYWxzLiBOb3QgcmVnaXN0ZXJlZD8gQXBwbHkgbm93LiBBY2Nlc3MgZXhwaXJlZD8gUmVhdXRob3JpemUgbm93LiJ9

- https://www.bis.org/cpmi/publ/d174.pdf

- https://www.bis.org/publ/othp33.pdf

- https://www.zerohedge.com/markets/china-will-be-first-country-launch-digital-currency-what-happens-then

- https://www.coindesk.com/spanish-city-lebrija-launches-local-virtual-currency-elio

- https://www.imf.org/en/Publications/WP/Issues/2020/11/20/Legal-Aspects-of-Central-Bank-Digital-Currency-Central-Bank-and-Monetary-Law-Considerations-49827

- file:///C:/Users/DELL/Downloads/TheFutureofMoneyandtheCentralBankDigital-Sustainability.pdf

- https://www.bis.org/publ/work880.pdf

- https://www.nisg.org/blockchain

- https://www.livemint.com/industry/banking/no-way-privately-issued-digital-currencies-can-be-allowed-says-rbi-governor-11575535494050.html

This paper was first published in the January 2021 issue of ‘The Management Accountant’, the monthly Journal of the Institute of Cost Accountants of India.

About the Author

Dr. Paritosh Basu is presently a full-time Senior Professor of NMIMS University School of Business Management, Mumbai. He is a scholarly academician and a digital evangelist. He is also engaged in various research and consulting activities. Earlier he served large Indian corporates for about thirty-four years with last two assignments being of Global Group Controller and CFO in two large Indian MNCs.

He may be contacted at [email protected] or @paritoshbasu.

Main image credit: Photo by Viktor Forgacs on Unsplash